Saving money and becoming financially literate are skills that can transform your life. Whether you aim to build a safety net, prepare for future investments, or simply stop living paycheck to paycheck, the path starts with understanding where your money goes and how you can make it work for you. Financial literacy isn’t reserved for finance professionals—it’s something every person can develop with the right mindset and consistent habits.

Understand Your Current Financial Situation

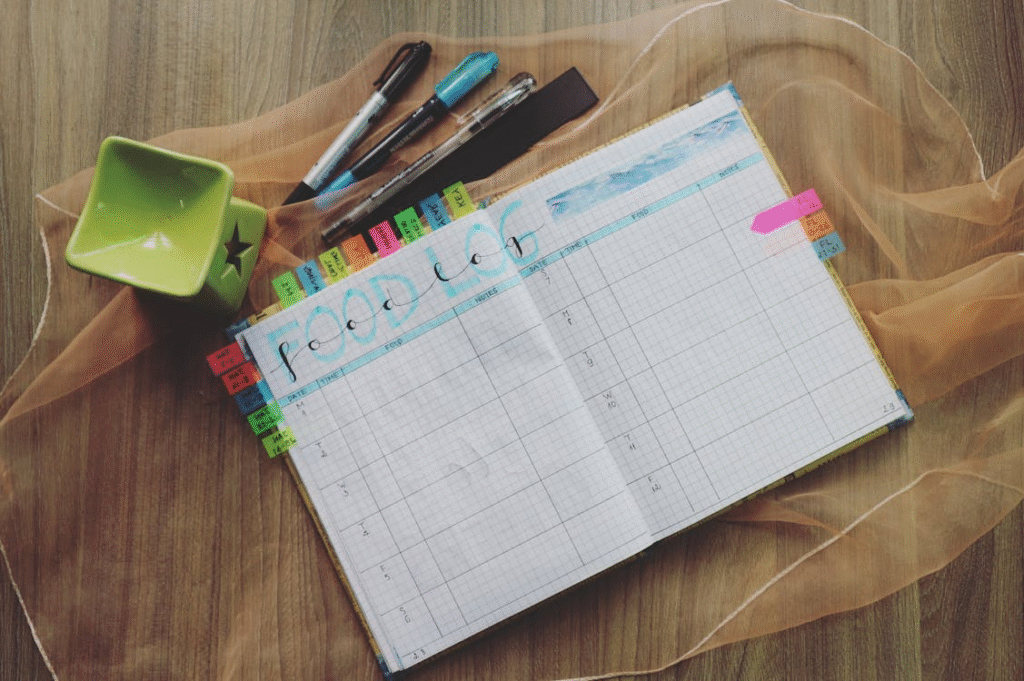

The first step toward effective money management is gaining clarity about your financial picture. This includes your income sources, monthly expenses, savings, and any outstanding debts. When you track your money honestly and consistently, patterns begin to emerge. You may notice unnecessary spending, forgotten subscriptions, or habits that can be adjusted.

Building awareness allows you to make informed decisions instead of reacting to financial surprises. A simple spreadsheet or budgeting app can help you monitor your cash flow, categorize expenses, and set achievable financial goals.

Build a Realistic Budget You Can Stick To

Budgeting is the foundation of financial discipline. A well-structured budget gives you a plan for your money instead of letting it drift into impulse purchases or unplanned expenses. Instead of creating a restrictive budget, focus on one that matches your lifestyle and long-term goals.

Start by dividing your expenses into needs, wants, and savings. Some use the 50/30/20 rule, where 50% goes to essentials, 30% to lifestyle choices, and 20% toward savings or debt repayment. Adjust these ratios based on your unique circumstances, but always include a category for saving—even if it’s a small amount in the beginning.

Strengthen Your Financial Knowledge

Financial literacy involves understanding concepts like interest rates, emergency funds, credit scores, insurance, investing, and tax planning. It may sound overwhelming at first, but learning a little at a time builds confidence and control.

Books, short courses, and credible online resources can guide you through the basics. Once you gain foundational knowledge, you’ll be in a better position to make informed financial decisions. For instance, planning for occasional expenses such as flower delivery in Waterloo or transportation needs like wedding car hire in Meath becomes easier when you know how to set aside funds for both expected and unexpected purchases.

Set Short-Term and Long-Term Goals

Clear financial goals give your budget direction. These goals might include building a three-month emergency fund, paying down debt, saving for higher education, or preparing for retirement. Divide major goals into smaller, manageable steps so you can maintain momentum and motivation.

Short-term goals can include saving a specific amount monthly or cutting back on non-essential spending for several weeks. Long-term goals may require strategies such as investing, opening a high-yield savings account, or consulting financial tools like Lamina.ca for planning guidance. Regularly review your goals and adjust them as your circumstances change.

Reduce Unnecessary Expenses

To save more effectively, reassess your spending habits. Are there subscriptions you no longer use? Could you cook at home more often instead of dining out? Are impulse purchases eating into your budget?

Track small purchases—they add up quickly. Sometimes, simply being aware of where your money goes naturally reduces overspending. Try using cash for discretionary purchases or creating a waiting period before buying non-essential items. These small behavior shifts can lead to significant savings over time.

Build an Emergency Fund

An emergency fund protects you from financial surprises like car repairs, medical bills, or sudden job loss. Without one, you risk diving into debt or relying heavily on credit cards. Aim to save at least three to six months’ worth of essential expenses.

If that goal feels big, start small. Even setting aside a few dollars a day or week helps you build momentum. Automating deposits into a separate savings account ensures consistency without requiring extra effort.

Avoid and Manage Debt Wisely

Debt can be a major obstacle to both savings and financial independence. If you have existing debt, prioritize repayment based on interest rates. The snowball method—paying off smaller debts first—can build motivation, while the avalanche method—paying the highest interest rate debts first—saves money over time.

Avoid taking on unnecessary debt, especially for short-term desires. Use credit responsibly, and always aim to pay your balance in full when possible. You can explore a more detailed explanation of this topic at The Internet Chicks.

Stay Consistent and Review Your Progress

Financial literacy isn’t a one-time achievement—it’s an ongoing practice. Regularly review your budget, spending habits, and goals. Even small improvements can lead to big results over time. Celebrate your progress, whether it’s paying off a loan, growing your savings, or learning new financial concepts.

Consistency is the secret ingredient to long-term financial health. Over time, smart habits become second nature, allowing you to build a stable and secure financial future.

By committing to tracking your spending, setting clear goals, and growing your financial knowledge, you’ll empower yourself to make smart financial decisions every day. Financial literacy is not about perfection—it’s about progress, awareness, and building habits that support your long-term well-being.